Our early estimate is that DRIV Core returned +1.87% in June and is up approximately +6.63% YTD. Below is a brief synopsis of DRIV’s positioning.

Bottom line: We held our defensive positioning for the month. Equities ramped after the steep May sell-off. Macro conditions continue to worsen with regional PMI’s at near their worst levels in a decade. Bond markets deepened their inversions in the U.S. and globally. The 3 mo.-10 yr UST curve has been at or nearly inverted since March. Nearly $13 trillion of global debt is trading at negative yields. On many metrics, market valuations have never been this steep historically and signal low to negative real returns over long horizons. Wilshire 5000 to GDP is c. 140% of GDP after peaking at a record 146% in Sep 2018. To put things in perspective, the Nikkei bubble in 1989 peaked at around 130% of GDP. The UST 10 year yield declined further to 2.00% from 2.51% at the beginning of May and 3.25% in October 2018—a massive decline in yield. We are long 75% U.S. Treasury and 5% cash exposure, while our approx. 20% equities risk style is tilting toward growth and our largest single combined exposure is large value. We remain significantly underweight small caps.

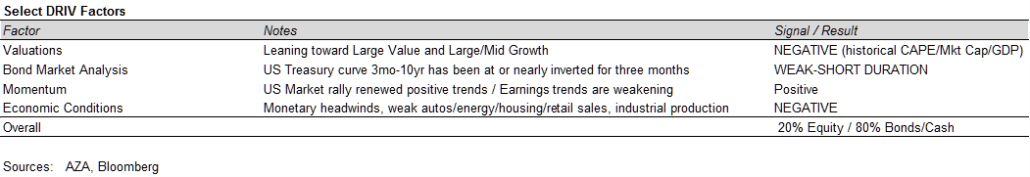

With our risk barbell of 20% equities / 20% longer duration U.S. Treasuries / 60% ST USTs and cash, DRIV is very defensive. Our dashboard is negative on valuation, bond market analysis and macroeconomic conditions. We will need broad market valuation and bond market conditions to resolve themselves before materially increasing equity exposure.

Related Commentary:

Central Banks: The Fed and Quantitative Tightening (QT): Monetary policy is still critical to maintaining markets though the Fed tightening cycle is clearly having effects on the real economy. The Fed opened the door to cuts in June. This is a complete 180 degree turn from Chair Powell’s October “nowhere near neutral” comments. Fed Fund Futures may be interpreted to price approx. 1.25% in interest rate cuts through the end of 2020. U.S. monetary policy is creating a dollar shortage globally, which could be negatively impacting activity.

Trade War

At the G20 the U.S. backtracked on trade negotiations failing to raise tariffs to 25% on the remaining c. $300 billion of untaxed Chinese imports and also allowing U.S. chip companies to send components to Huawei. On net, China came out the winner from the summit and U.S. semiconductor stocks briefly rallied.

When our models suggest that positive conditions and trends have resumed we will update you with any key changes as they arise.

Leave a Reply