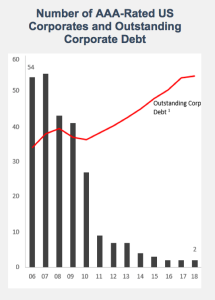

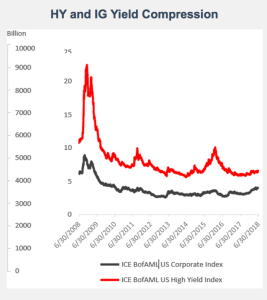

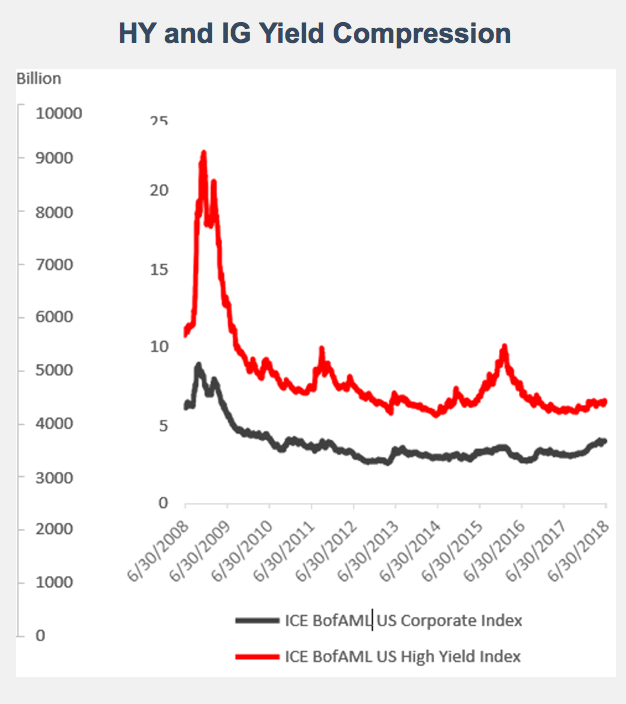

The unprecedented monetary easing following the Global Financial Crisis has resulted in the compression of risk premiums across all asset classes and in our view has been most acute in fixed- income. The charts below show a compression in yields across both investment grade and high yield while at the same time we can see the reduction in credit quality with the decline in the number of AAA rated corporates from 54 in 2006 to 2 in 2018 combined with corporate leverage exceeding the pre-crisis high.

Against this backdrop, investors should be mindful of searching for yield against a backdrop of rising leverage and declining credit quality. Even private debt markets have not been immune from the compression in yields and we are seeing investors focus on absolute yield increasingly at the expense of credit quality and duration.

We believe that given that we are in the later stages of the economic cycle, investors should be paying greater emphasis on credit quality, collateralization and short duration. As a result, in our view short duration private credit investments represent the most attractive risk-reward opportunity to generate income but also a return profile that exhibits low correlation to equities and public market fixed-income.

Leave a Reply